Mentor Article

Healthcare Costs in Retirement

Our Mentors

Bob Halagan

Halagan Law Firm, LTD.

Roben Hunter

Hunter Advisors, PLLC

Casey A. Mattson

JM+SC Futurity

Gary Sorenson

Insurance Brokers of Minnesota

Kevin Lanigan

Carlson Estate Planning

Sheri Stolp

The Stolp Group

Michael Sherrill

Sherrill Law Offices

Sharon Berglund

Berglund HR Consulting

Mark Hegstrom

Waterfront Financial Group

Suzie Meier

Red Technologies Inc.

Bruce McAlpin

The McAlpin Team

Edina Realty

Shaun Corbin

First Minnesota Bank

Gayle Noakes

Gayle Noakes Supervisor Success

Stacey R. Edwards Jones

Jones Law Office

Mark Hegstrom, Waterfront Financial Group

Oct 1, 2016

American workers are split about 50/50 when asked if they are confident they will have enough money to pay for medical expenses in retirement.

In a 2015 survey, 42% of all workers reported they were “not too” or “not at all” confident they would have enough money to pay for their medical expenses in retirement. Fifty-six percent said they were “very” or “somewhat” confident they could pay the cost.¹

Regardless of whether you’re confident or not, it’s important to have an idea about how much healthcare may cost in retirement. By putting the costs in better perspective, you might be able to better understand what you can pay for and what you can’t.

Tip: Medicare beneficiaries spent an average of $4,734 out of pocket on health care in 2010, the most recent year for which figures are available. Forty-two percent of that went to premiums, 20% to long-term care facilities.

Source: MedicareResources.org, October 24, 2015

HEALTH-CARE BREAKDOWN

A retired household faces three types of health-care expenses.

- A household may have the expense of premiums for Medicare Part B (which covers physician and outpatient services) and Part D (which covers drug-related expenses). Typically, Part B and Part D are taken out of a person’s Social Security check before it is mailed, so the premium cost is often overlooked by retirement-minded individuals.

- The household should expect to pay for co-payments related to Medicare-covered services that are not paid by Medigap or other health insurance.

- The retired household should expect to pay for dental care, eyeglasses, and hearing aids, which are typically not covered by Medicare or other insurance programs.

IT ALL ADDS UP

Fast Fact: Nursing Home Costs. In 2015, the national average rate for a private room in a nursing home was $92,378 a year. The national average rate for a semi-private room in a nursing home was $82,125.

Source: Genworth 2016 Cost of Care Survey

According to a HealthView Services study using more than 50 million actual cases, a healthy married couple, age 65, can expect these healthcare expenses to add up to $267,000 over their lifetime. If you include dental, vision, co-pays, and out-of-pocket costs, the total rises to $395,000.²

For a healthy 55-year-old couple who plans to retire in a decade, the number jumps to $464,000. ³

Should you expect to pay this amount? Possibly. Seeing the results of one study may help you make some critical decisions when creating a strategy for retirement. Without a solid approach, health-care expenses may add up quickly and alter your retirement spending.

OUT-OF-POCKET HEALTH-CARE COST

The cost of health care for a 65-year-old couple is projected to increase with age.

| Age 65 | Age 85 | |

| Annual cost | $6,999 | $14,530 |

| Monthly cost | $583 | $1,211 |

Source: CNBC, March 27, 2015

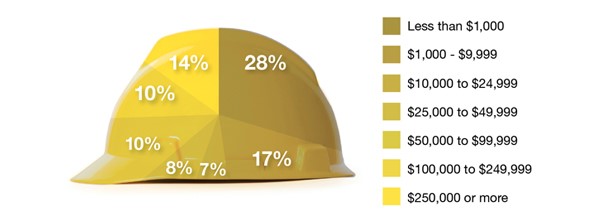

PREPARED FOR THE FUTURE?

Workers were asked how much they have saved and invested for retirement — excluding their residence and defined benefit plans.

Employee Benefit Research Institute, 2015 Retirement Confidence Survey.

- Employee Benefit Research Institute, 2015 Retirement Confidence Survey

2,3. CNBC, March 27, 2015

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG Suite is not affiliated with the named broker-dealer, state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security. Copyright 2016 FMG Suite.